Client Objective

Here, we set out to understand how fast food mobile apps are used, while also assessing brand loyalty for the ‘Just Eat’ app. Specifically, the client needed to know:

- How many respondents are using each app?

- Which other apps have users of the Just Eat app used?

- How often do Just Eat users use the app?

- Which activities are most likely to occur prior to using the Just Eat app?

- Social exposure — how many times do users utilise each social app the day before, during and after using the Just Eat app?

Solution

First, we posed a series of questions of the passive data; we asked respondents about which of the following 13 apps they used in the last 28 days, followed by how many times they used each app within the same timeframe.

- Just Eat

- hungryhouse

- UberEATS

- Deliveroo

- Pizza Hut

- Domino’s

- Papa John’s

- McDonald’s

- Nando’s

- Burger King

- KFC

- Gousto

- HelloFresh

Next, we asked respondents an open text answer, “What were the last 5 things you did before using the Just Eat app?” extracted from RealityMine’s passive data, but presented as if the question had just been answered.

Data was then extracted from RealityMine’s RealLife Answers feeds and exported in the below user-friendly formats, where data was contained in a single row for respondents and codebooks were automatically generated:

- Excel

- CSV

- Triple-S

Results

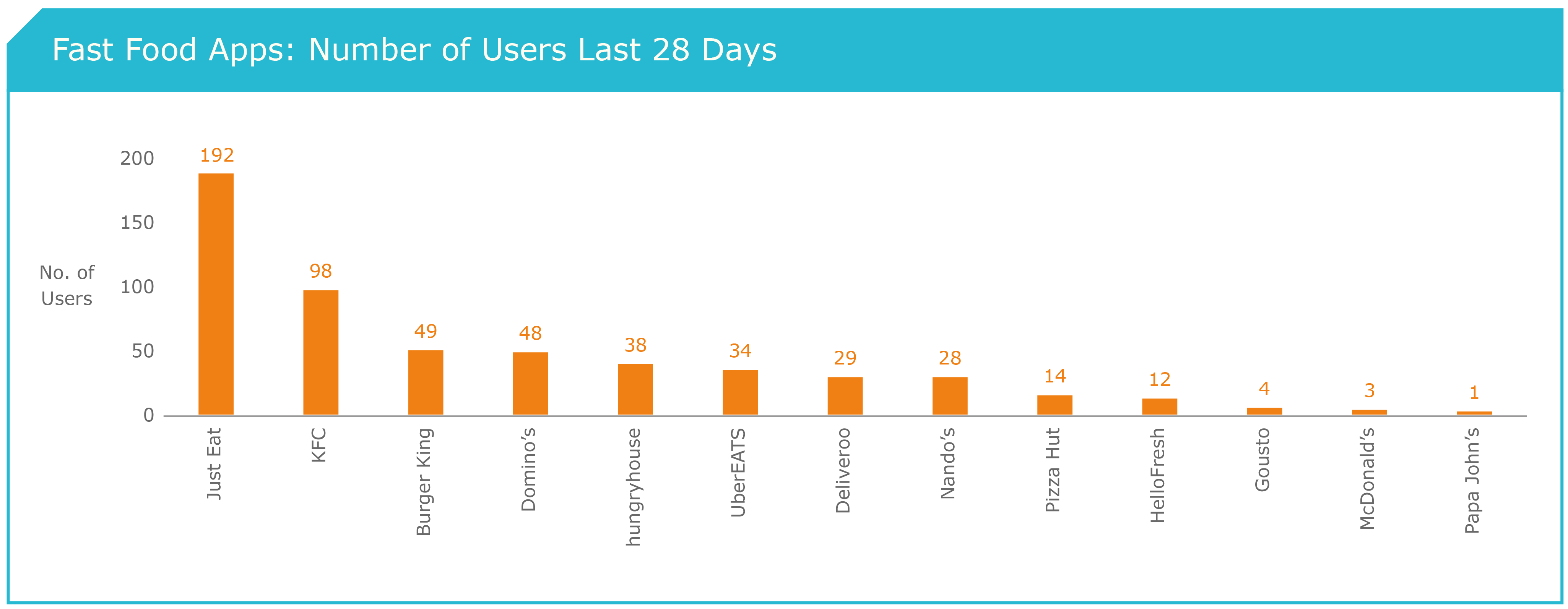

As illustrated in the graph below, Just Eat is by far the most popular fast food app among UK consumers, nearly doubling the second most popular app (KFC) in a sector dominated by delivery apps rather than restaurant brands. From this, we can also confirm that Just Eat’s strategy to recently add KFC to its delivery service in the UK and Ireland makes sense from a business perspective as it is dominant for casual dining apps and brands.

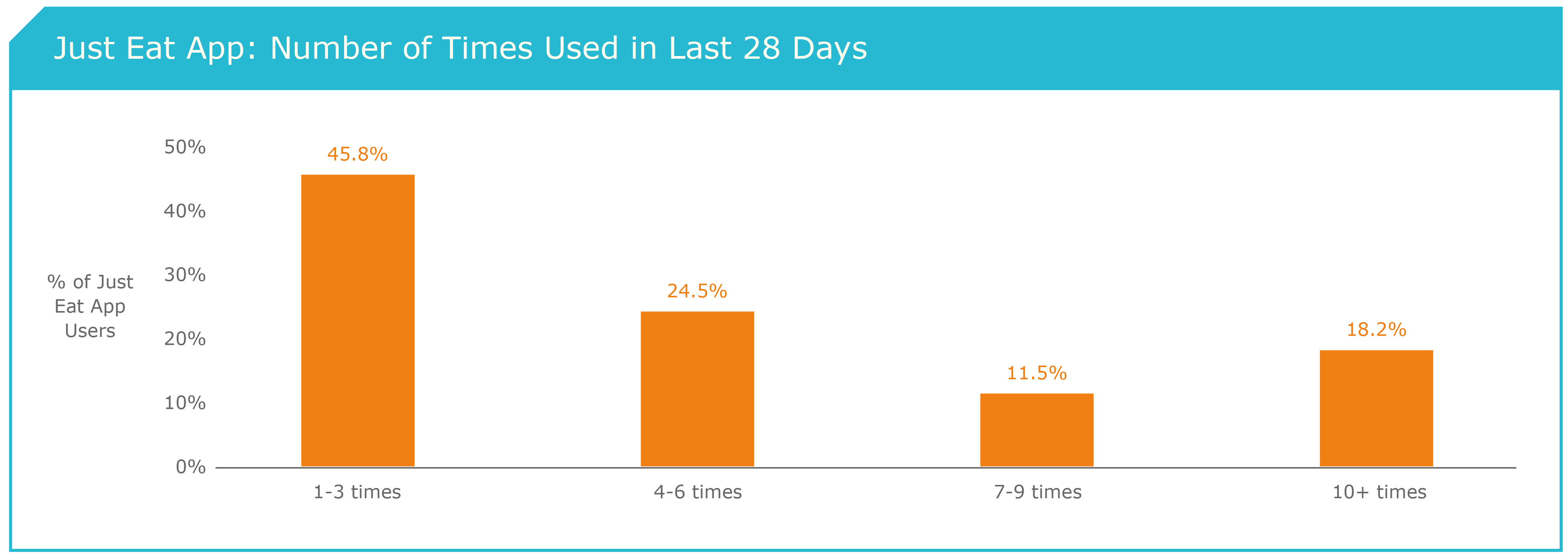

Furthermore, we found that Just Eat has a relatively high brand loyalty, with 45.8% of app users accessing the app 1-3 times within a 28-day timeframe, and 18.2% of app users accessing the app more than 10 times within the same timeframe.

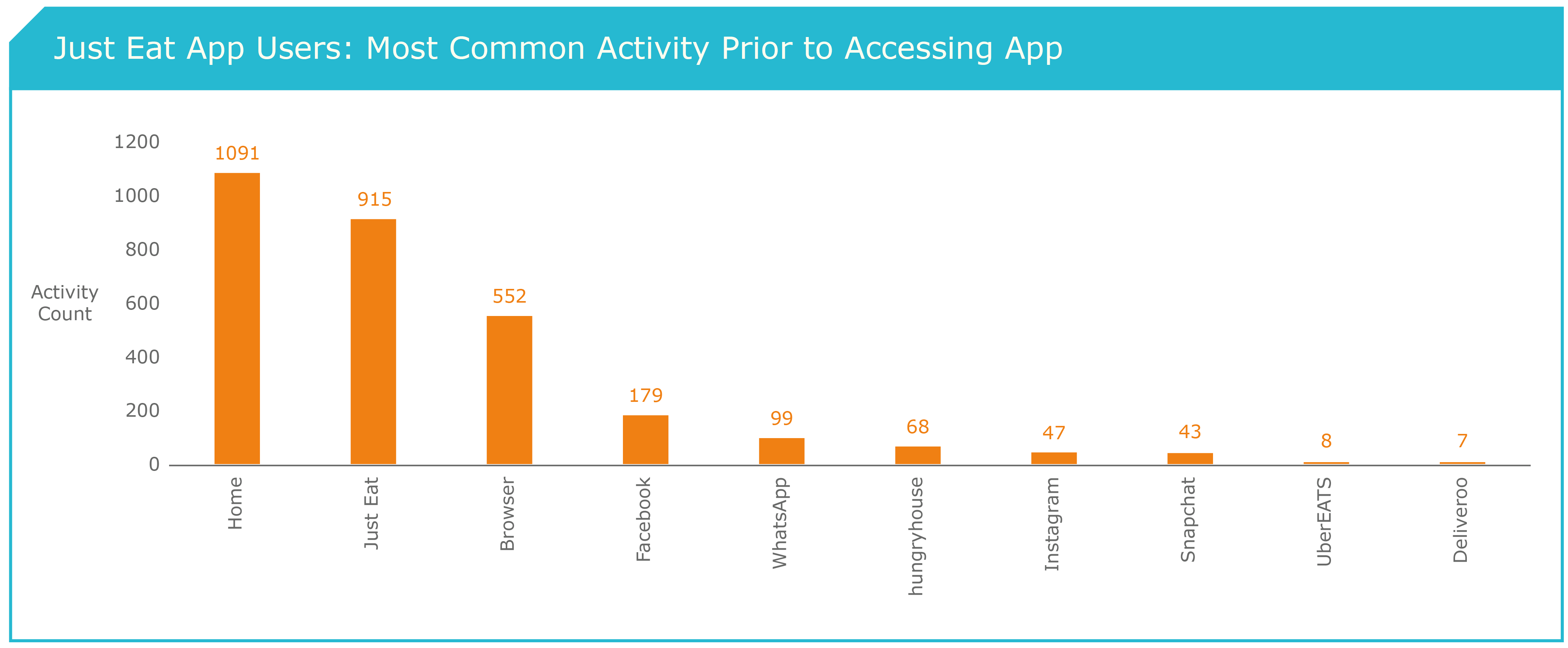

Looking further into the passive data, we also found that the majority of traffic to the Just Eat app originates from the home screen. Furthermore, we found that a number of sessions with the Just Eat app are broken by the users’ smartphone screens locking up, and that the purchase process can span several individual app sessions. We also noticed a lot of activity directly between Just Eat and the hungryhouse app, which we associated with users comparing various deals and offers.

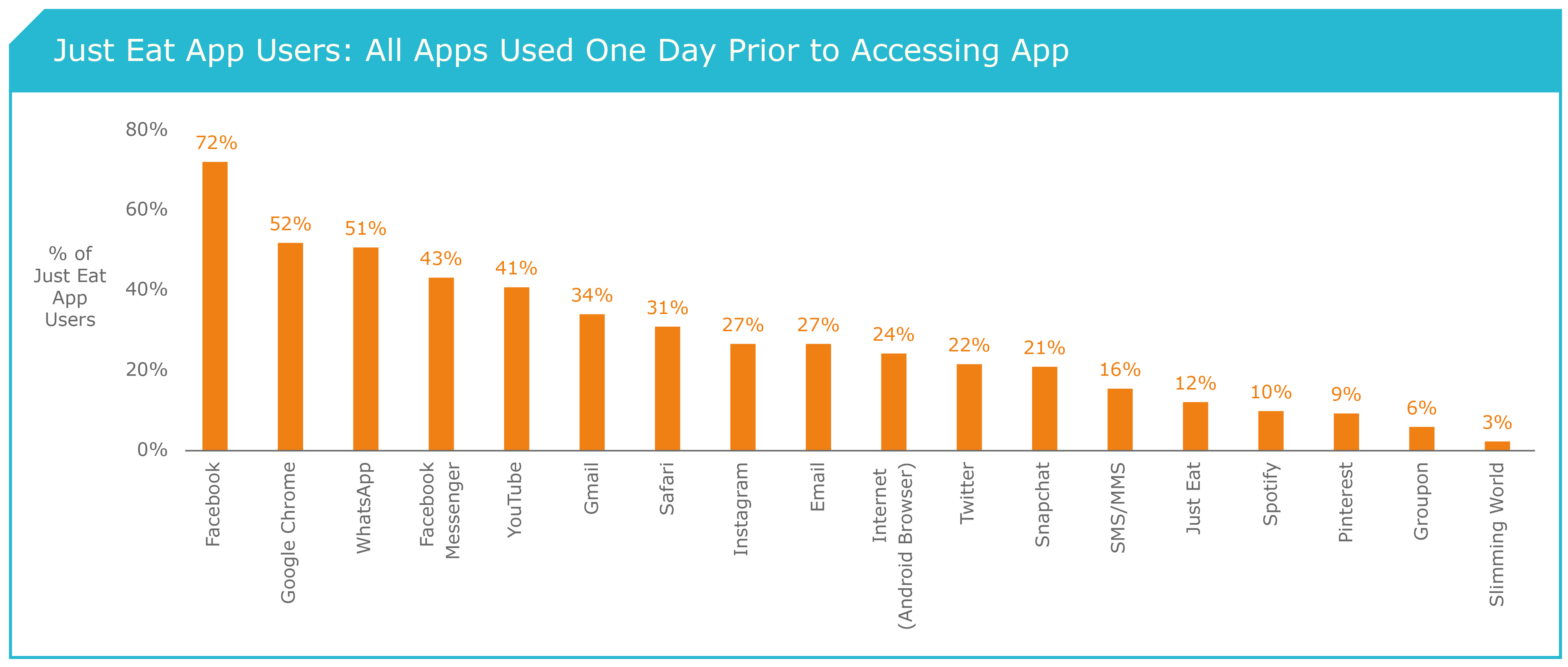

Finally, we looked at which apps were being used one day prior to accessing the Just Eat app. As illustrated in the graph below, Facebook is the app most predominantly used (72%). Just Eat can then use this information to optimise their marketing campaigns and reach their chosen demographic within the purchase decision-making process.

Additionally, we found that 12% of customers use the Just Eat app on consecutive days.