AI isn't just changing how apps work—it's fundamentally rewriting consumer behavior. And it's happening faster than most businesses realize.

Recent integrations allowing retail purchases directly within ChatGPT represent just one example of how quickly the ground can shift. For app owners and digital platforms navigating over 3 million competing apps, the question isn't whether disruption is coming. It's whether you'll see it in time to respond.

The introduction of retail purchasing within ChatGPT created an entirely new consumer behavior overnight. For retailers and app platforms, this shift presents both threat and opportunity. How do you position yourself as the trusted data source that AI platforms rank highly? How do you even know if your business is being affected?

The challenge is velocity. What took months or years to shift in previous eras can happen in days or weeks now. Consumers are literally a click away from behavior change, and traditional quarterly reviews are far too slow to catch these shifts.

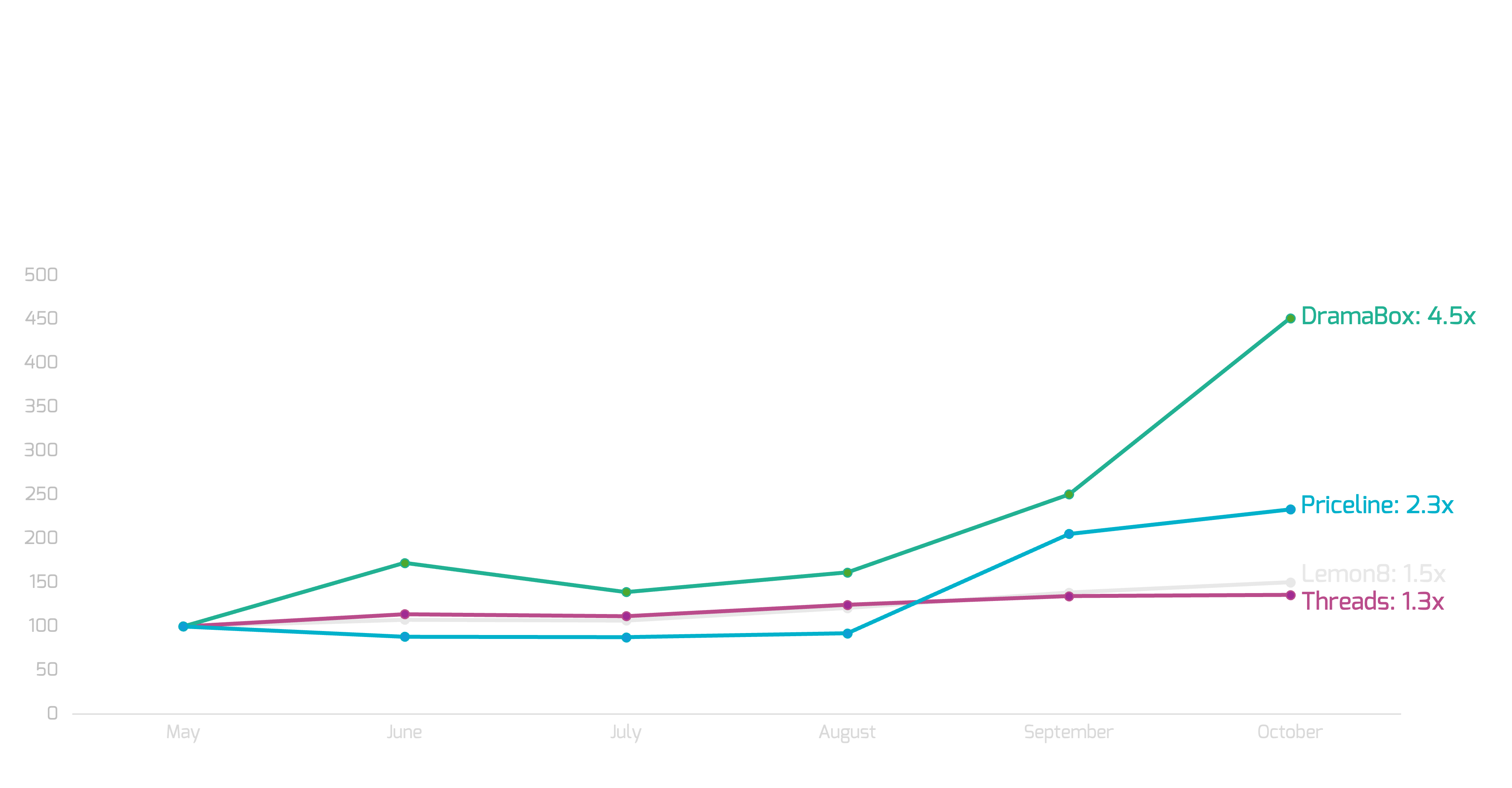

Line graph showing relative app growth from May to October 2025, with DramaBox growing 4.5x, Priceline 2.3x, and LemonB and Threads showing moderate growth

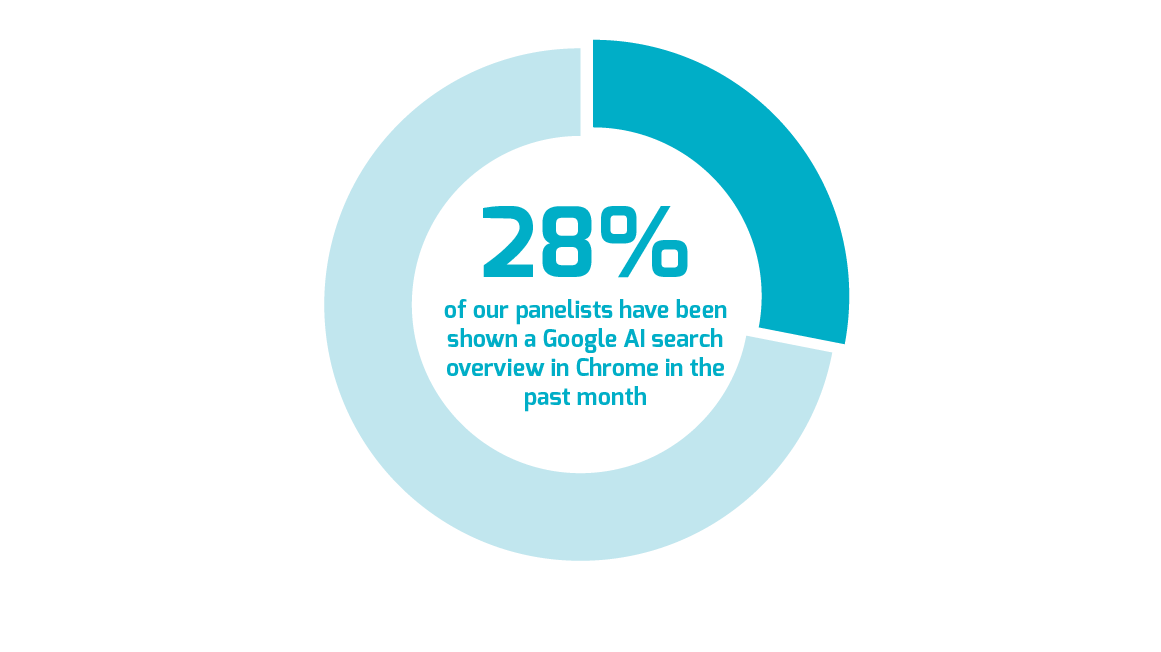

The impact on search behavior offers the most visceral example of AI-driven disruption. Consumers increasingly use large language models to access information and conduct searches that would have previously gone to traditional search engines. This affects not just search platforms but any business relying on search-driven discovery.

Users now get direct answers without clicking through to websites. Platform-integrated AI appears in social media, productivity tools, and messaging apps. Personalized synthesis pulls together information unique to each user's prompt. How consumers find brands, products, and services is fundamentally changing—and it's changing the competitive landscape along with it.

Consider Meta's recent "Vibes" feature, allowing users to create AI-generated content rather than real videos. This single feature has implications beyond Meta—it affects how the entire media world thinks about content creation. Will users engage with purely AI-generated content? Understanding consumer reaction in real-time becomes a bellwether for much larger industry changes.

These micro-details matter enormously. They help project forward and inform strategic changes, whether you're in media, retail, technology, or any category where apps drive customer engagement.

The apps that seemingly come from nowhere—Shein, Temu, historically TikTok—can capture significant market share within months. AI features can change consumer behavior overnight. In this environment, businesses need behavioral tracking to spot threats and opportunities while there's still time to respond strategically rather than reactively.

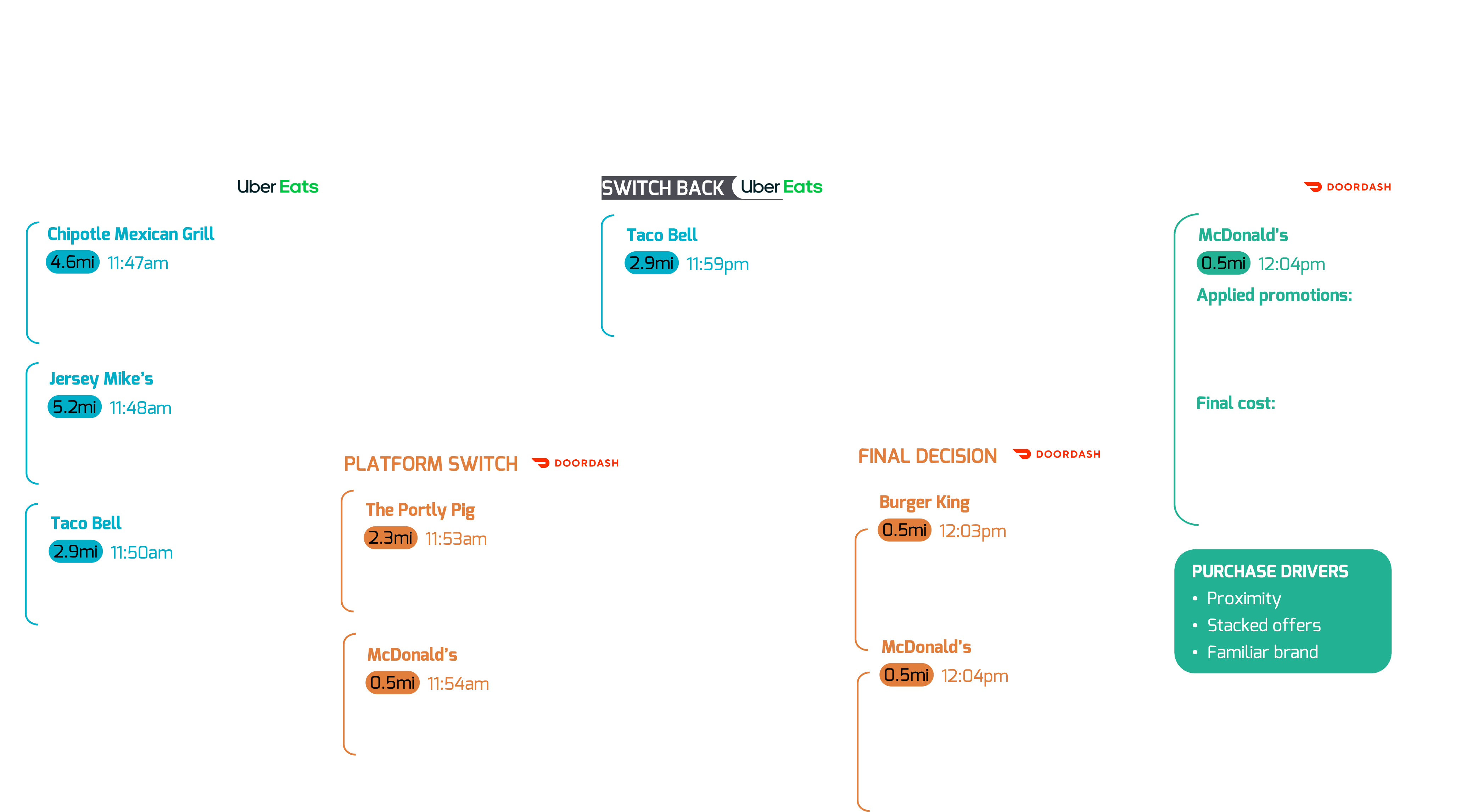

It's not enough to know that a competitor's app is growing or that AI is changing search behavior. You need to understand why at a granular, feature-level detail across the entire consumer journey.

Real app competitive intelligence means capturing the complete consumer app journey with unprecedented granularity:

This granular view transforms both tactical marketing and product strategy. Tactically, you can track week-to-week competitive positioning with precision. Strategically, you can learn rapidly from consumer adoption of competitor features to inform your own product roadmap.

The competitive battleground in digital products is at the feature level. Understanding what truly drives behavior requires seeing beyond your walls—seeing what consumers do across the entire app ecosystem, not just within your platform.

Some of the most valuable intelligence comes from studying users who aren't your customers. How do they interact with competitive apps? What features drive their loyalty? What pain points remain unaddressed? This early visibility into emerging patterns can inform everything from product development to market positioning.

In an environment where AI can create overnight disruption, watching the early adopters—even when they're using competitor platforms—provides critical signals about where markets are heading.

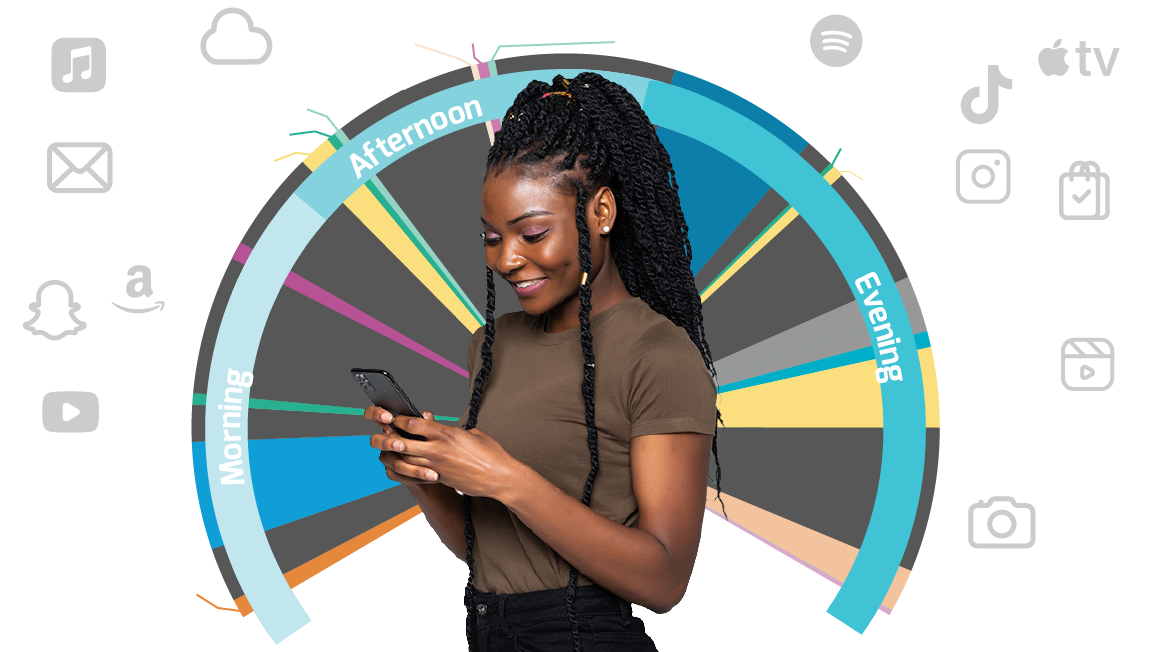

Here's the fundamental problem: the average smartphone user has between 250 and 650 app interactions every day, each lasting nine seconds to two minutes. They move effortlessly from YouTube to TikTok to ChatGPT to Walmart in just a click.

Meanwhile, most apps are trapped in data blind spots—they see only what happens within their own walls. You can't see TikTok coming by looking at your own analytics. You can't understand why users suddenly prefer a competitor's AI-powered feature. You can't track how ChatGPT shopping is pulling users away from your conversion funnel.

When 70-80% of user time is spent within a small set of platforms, understanding behavior across those platforms becomes critical. The concentration of competition into dominant apps, combined with AI-driven disruption, makes cross-platform behavioral intelligence essential for strategic decision-making.

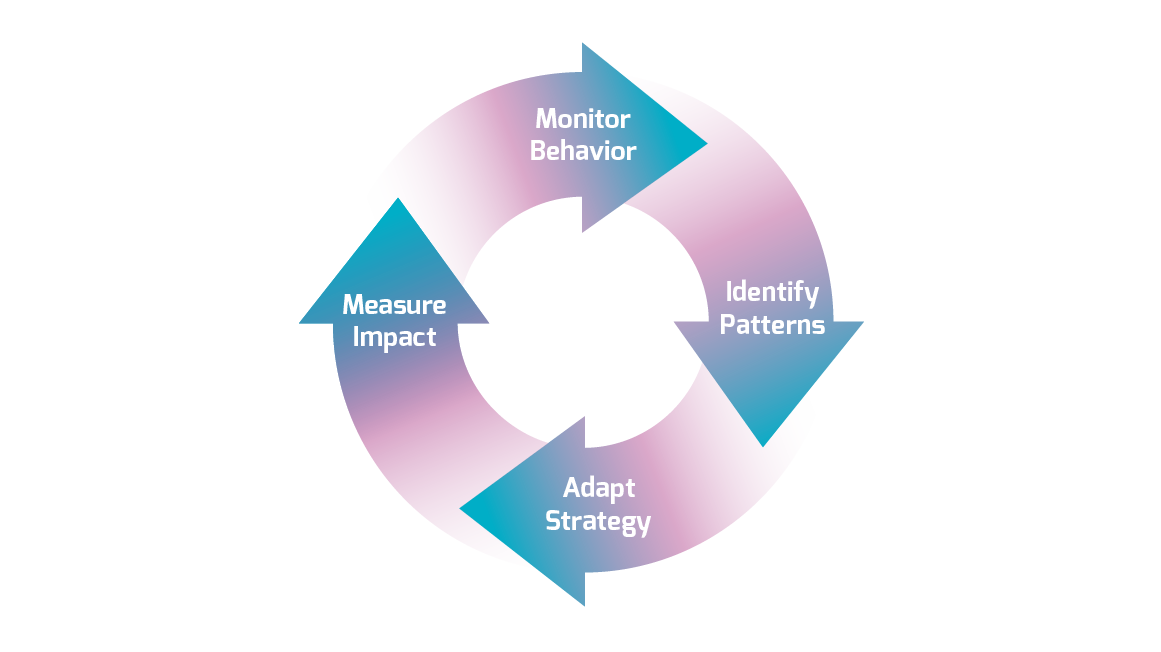

The confluence of AI-driven disruption, intense competition, and platform concentration demands a new approach: continuous behavioral tracking across the mobile app ecosystem—not just within your platform.

Monitor in real-time:

Leverage the fast follower advantage. Not every company needs to be first with every innovation. Apple built an empire on "getting it right" rather than being first. But fast follower strategies only work if you have intelligence infrastructure to see what's working for first movers—and why.

While traditional assets like brand loyalty and user bases provide defensive moats, they only protect you if you're watching consumer behavior closely enough to see threats emerging and can react swiftly. In the AI era, reaction time is everything.

The app economy has reached an inflection point. Success requires breaking through walled gardens with authenticated, opt-in behavioral data that reveals the complete picture of consumer app journeys.

Companies that will thrive combine first-party data strengths with genuine behavioral intelligence across the app ecosystem. They see emerging competitors before those competitors become existential threats. They understand which features truly drive adoption. They track how AI is changing customer behaviors in real-time, not six months later.

In a world of AI-accelerated disruption, the most important competitive advantage isn't having more data—it's having the right data: behavioral, granular, real-time, and authenticated across the entire app economy.

How can apps see competitor behavior when data is siloed in walled gardens?

Authenticated behavioral data from opted-in consumers reveals cross-platform behavior patterns. This consent-based approach captures actual user journeys across multiple apps, showing not just what happens within a single platform, but how consumers move between different ecosystems while respecting privacy and platform boundaries.

What types of behavioral data give apps a competitive advantage?

The most valuable data operates at the feature level. This includes tracking which specific features within competitor apps drive adoption, how long consumers spend evaluating alternatives, which apps they consider within a single journey, and real-time usage shifts when new features emerge. Granular interaction data—session duration, feature engagement, cross-app sequences—provides actionable intelligence that aggregate statistics can't match.

How is AI changing the way consumers discover and use apps?

Large language models are replacing traditional search for information needs. Platform-integrated AI is changing how users interact with familiar apps. New behaviors like in-chat purchasing bypass traditional commerce flows entirely. These changes happen in real-time, requiring behavioral tracking to understand how AI adoption specifically affects your category and customer base.

Why is real-time app behavior tracking more important now than ever?

The velocity of change has accelerated dramatically. Apps like Shein, Temu, or TikTok can capture significant market share within months. AI features can change consumer behavior overnight. In this environment, monthly or quarterly competitive reviews are too slow. Behavioral patterns that matter emerge in days or weeks—real-time tracking allows businesses to spot threats and opportunities while there's still time to respond strategically.